Are you thinking about getting into foreign investment? If yes, right here are a few things to remember.

When it pertains to financial investments, risk is an unavoidable component. Foreign investment is no exception to this rule; actually, several experts state that there is perhaps an enhanced risk with foreign investments due to the fact that there is the additional risk called the 'forex risk'. So, what does this mean? Basically, the forex risk is the risk of losing money because of variations in currency exchange rates. Whether you buy or sell foreign currencies, goods, stocks or property, you must look at forex risk in your foreign investment scheme or strategy. Additionally, this is why one of the best foreign investment tips is to develop an internationally diversified multi-investment profile. Ultimately, investing in multiple countries and currencies will help you to spread out your risk and improve your chances of earning a profit. Another great suggestion is to invest in countries with low debt or GDP ratios and climbing currencies, as well as check the money's previous volatility patterns and here exchange rates, like the India foreign investment strategies.

Locating international investment opportunities is an exciting way to expand wealth and diversify your portfolio, as shown by the Brazil foreign investment ventures. Nonetheless, investing overseas features difficulties, like currency risks and navigating foreign policies. The good news is that these challenges can be handled with the right strategies. For instance, investing internationally doesn't necessarily mean you need to do it alone. Partnering with specialists who know local markets is one of the best bits of foreign investment advice for novices. This is since financial consultants with regional know-how can guide you through neighborhood laws and market conditions, help you examine risks better and pinpoint investment opportunities you might otherwise miss. It is their role to provide beneficial foreign investment insights and sustain you while navigating a rather new territory.

Prior to getting into the ins and outs of foreign investing, it is firstly crucial to understand what it actually means. Essentially, foreign investment refers to the monetary investments which are made in a different country. The general importance of foreign investment must not be neglected; it has a significant impact on both the investing and host countries, hence impacting job generation, intercontinental relations and economic development, as demonstrated by the Malta foreign investment strategies. Before you can get involved in foreign investment, you should first of all do your due diligence and research it thoroughly. Nevertheless, it is a diverse and multi-layered field, so it is important to have a clear understanding of all the different types of foreign investment there are. Broadly speaking, foreign investment falls into two groups; foreign direct investment (FDI) and foreign portfolio investment (FPI). So, what is the distinction in between the two? To put it simply, FDI involves a firm from one country taking a controlling stake or establishing a business in another nation. You can either have a horizontal FDI or a vertical FDI, with a horizontal FDI being the replication of an existing firm's procedures into a foreign country and a vertical FDI being the expansion of a phase of the supply chain into a foreign nation. On the other hand, FPI includes investors acquiring securities, like stocks and bonds for instance, of foreign companies without actually controlling them. Making sure that you understand all of these subtleties should always be one of the very first things you do before getting involved in international investment.

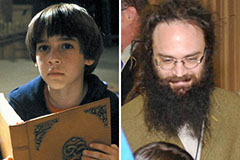

Barret Oliver Then & Now!

Barret Oliver Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!